• First Africa Life Insurance • Financial-house

Build your Financial

House

When you build it right the first time

you don’t have to re-build

and re-build again

We use cookies to optimise the user experience.

• First Africa Life Insurance • Financial-house

Build your Financial

House

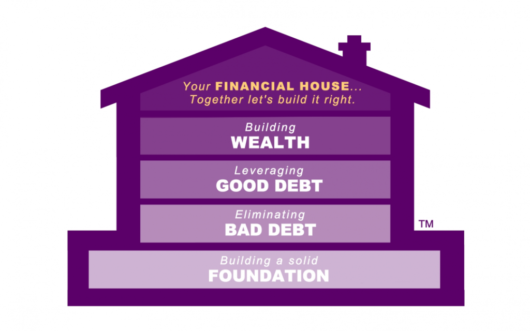

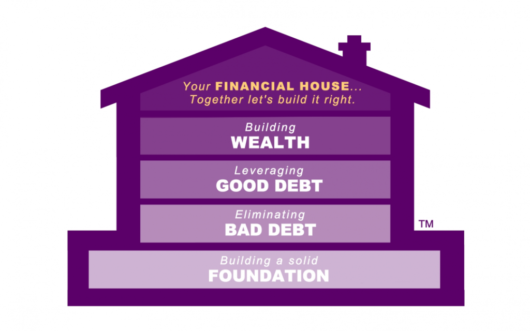

Building your financial house is a metaphor for creating a solid financial plan that includes a strong foundation, sturdy walls, a dependable roof, and a well-designed bedroom. The foundation of your financial house is investing in yourself, which includes education and strengthening personal assets. The walls represent investments that add value to your portfolio, while the roof represents investments that carry the highest risk you can tolerate. The bedroom represents the space for saving and investing. To build your financial house, you need to create a detailed plan that includes every aspect of your financial future, such as budgeting, automating savings, planning out your goals, reviewing your investment mix, insurance coverage, retirement plan contributions, and beneficiaries. It is essential to work with a financial advisor to design and maintain your financial house for the long term, as mistakes and oversights can be costly, especially when you’re closing in on retirement

Building your financial house is a metaphor for creating a solid financial plan that includes a strong foundation, sturdy walls, a dependable roof, and a well-designed bedroom. The foundation of your financial house is investing in yourself, which includes education and strengthening personal assets. The walls represent investments that add value to your portfolio, while the roof represents investments that carry the highest risk you can tolerate. The bedroom represents the space for saving and investing. To build your financial house, you need to create a detailed plan that includes every aspect of your financial future, such as budgeting, automating savings, planning out your goals, reviewing your investment mix, insurance coverage, retirement plan contributions, and beneficiaries. It is essential to work with a financial advisor to design and maintain your financial house for the long term, as mistakes and oversights can be costly, especially when you’re closing in on retirement

When you build it right the first time

you don’t have to re-build

and re-build again

A strong foundation for your financial house can be built by allocating your most stable assets, such as savings, investments, and retirement accounts, to provide a reliable income and protect against market volatility, fluctuating interest rates, and other risks.

These assets should be chosen carefully and reevaluated regularly to ensure they continue to meet your financial goals and risk tolerance.

Making occasional upgrades and repairs to your financial portfolio can also be important for maintaining its value and ensuring it stays aligned with your goals and risk tolerance. This may involve rebalancing your portfolio, adjusting your investment strategies, or seeking a second opinion or complete renovation if necessary.

A strong foundation for your financial house can be built by allocating your most stable assets, such as savings, investments, and retirement accounts, to provide a reliable income and protect against market volatility, fluctuating interest rates, and other risks.

These assets should be chosen carefully and reevaluated regularly to ensure they continue to meet your financial goals and risk tolerance.

Making occasional upgrades and repairs to your financial portfolio can also be important for maintaining its value and ensuring it stays aligned with your goals and risk tolerance. This may involve rebalancing your portfolio, adjusting your investment strategies, or seeking a second opinion or complete renovation if necessary.